Section 179 Deduction 2024 Vehicle List California

Section 179 Deduction 2024 Vehicle List California – Long ago, in 1958 Congress passed one of its many laws making “technical corrections” to the Internal Revenue Code. Mostly, these are truly technical corrections but there are times when . From employment to public health, here is a list of 24 new state laws coming to California in 2024. Shared Mobility Devices: Introduced by Assemblymember Reggie Jones-Sawyer, AB 410 will expand on .

Section 179 Deduction 2024 Vehicle List California

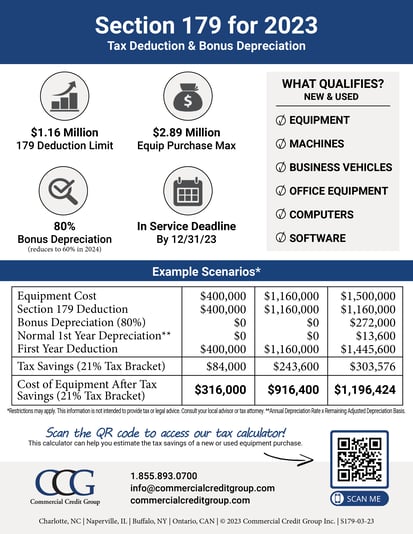

Source : www.commercialcreditgroup.comList of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in

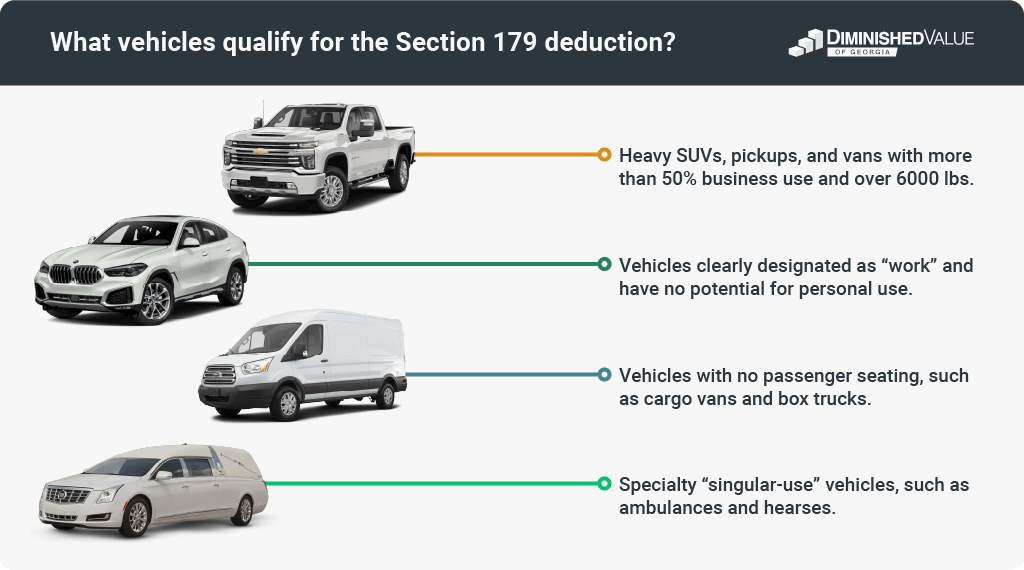

Source : diminishedvalueofgeorgia.comUpdate] Section 179 Deduction Vehicle List 2024 | XOA TAX

Source : www.xoatax.comNew 2024 Hyundai KONA Electric for Sale in Loma Linda, CA

Source : www.iehyundai.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comSection 179 Tax Savings on Hyundai Vehicles | Hyundai Inland Empire

Source : www.iehyundai.comSection 179 Vehicles For 2024 Balboa Capital

Source : www.balboacapital.comNew 2024 Hyundai PALISADE for Sale in Loma Linda, CA

Source : www.iehyundai.comNew 2024 Land Rover Range Rover Velar For Sale at Land Rover

Source : www.landroveroflivermore.comNew 2024 Hyundai ELANTRA for Sale in Loma Linda, CA

Source : www.iehyundai.comSection 179 Deduction 2024 Vehicle List California Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions: Necessary expenses are those appropriate for your business, such as gasoline expense for your delivery vehicles You cannot use the Section 179 deduction for inventory you purchase for resale . California offers a standard and itemized deduction for taxpayers. The 2023 standard deduction allows taxpayers to reduce their taxable income by $5,363 for single filers or couples filing .

]]>